The World Economic Forum (WEF) anticipates that the technology behind the virtual currency Bitcoin will come to occupy a crucial role in the global finance system.

The crypto-currency Bitcoin is not mentioned at all in the new 130-page World Economic Forum report. The organization rather explicitly backs the blockchain technology. “Rather than stay at the margins of the finance industry, blockchain will become the beating heart of it,” said Giancarlo Bruno, Head of Financial Services Industries at the World Economic Forum, in a press release published to coincide with the release of the report.

In the context of Bitcoin, blockchain originally signified the database in which all Bitcoin transactions were recorded and stored. Unlike the ledgers or databases that banks and other institutions utilize, a blockchain is not updated or operated by any one specific company or government agency, but rather by a network of users. That is precisely why the technology is also so attractive for the finance sector.

Blockchain, at least in theory, would allow one to transfer money and track transactions across borders and into other networks with increased security, transparency and effectiveness. This has motivated almost all banks and providers of financial services to start researching their own Blockchain solutions, often referred to as “Distributed Ledgers”. These distributed ledgers are particularly appealing to sectors with companies which lack a central institution to which they can entrust their records.

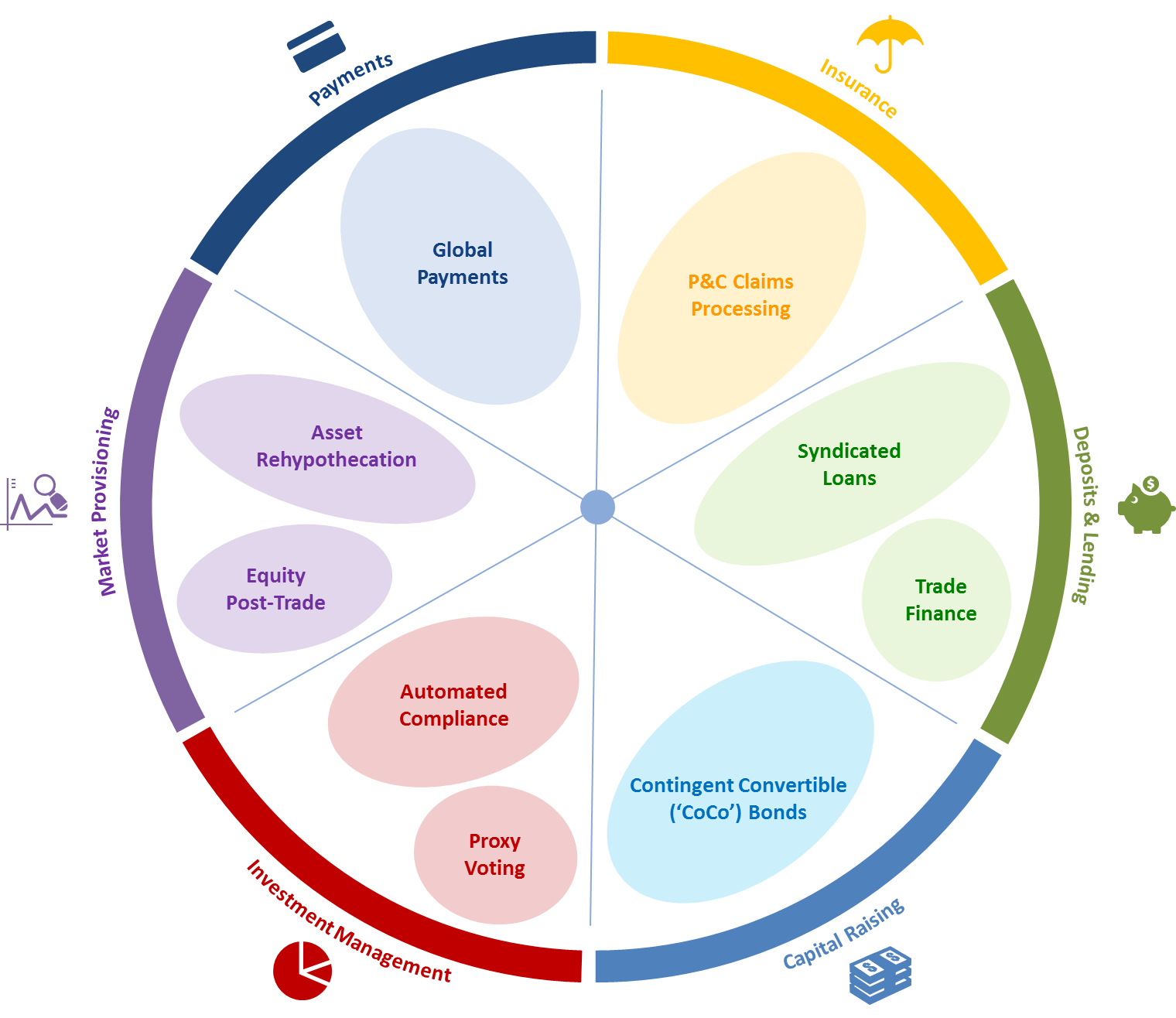

The WEF incidentally also assumes that most of the blockchain development will take place behind the scenes. The consumer would not actually see the changes to the infrastructure, but indeed benefit from the less expensive and quicker financial services resulting from them. The new technology is suitable for both mainstream transactions, such as global payments and stock trading, as well as for less well-known dealings, for instance trade financing or convertible bonds, the report goes on to say.

Projects aplenty, but still few tangible outcomes

According to the New York Times’ “Dealbook” blog the report is the outcome of a year of research in addition to five gatherings of executives from several major institutions, including JPMorgan Chase, Visa, MasterCard and BlackRock. It comes to the conclusion that already within the coming year 80 percent of banks around the world could well launch distributed ledger projects. But research conducted so far has led to few tangible results besides Bitcoin – which in turn has occasionally raised the question of whether blockchain is the proverbial solution which is searching for a problem.

As to the ongoing and recurring security issues that existing virtual currencies have faced (hackers recently helped themselves to Bitcoins worth more than €60 million from virtual exchange Bitfinex), the WEF report suggests that it will still take some time for such problems to be ironed out. Apart from technical issues, the industry and regulators will have to reach agreement on standard rules and laws.

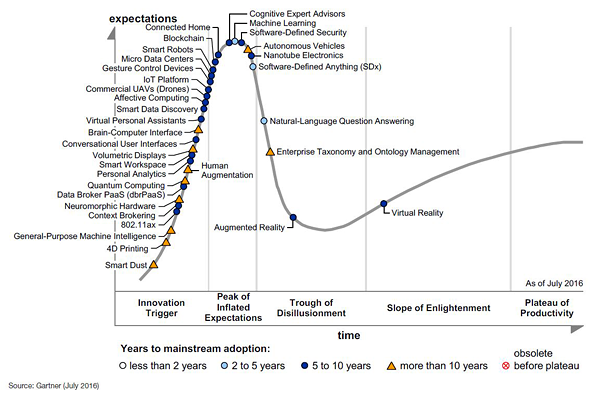

Market research and consulting experts Gartner recently published their Hype Cycle for Emerging Technologies 2016 report. It places blockchain still approaching the “Peak of Inflated Expectations”, meaning that it still has to dive through the “Trough of Disillusionment”, but at the same time identifies blockchain as a key platform technology which facilitates ecosystems.

Beyond the finance sector, in the long term one could imagine completely different uses for blockchain technology, which could allow whole processes to be verified and secured. It could turn out to have a substantial impact on the transmission of messages – senders and recipients would be authenticated conclusively.