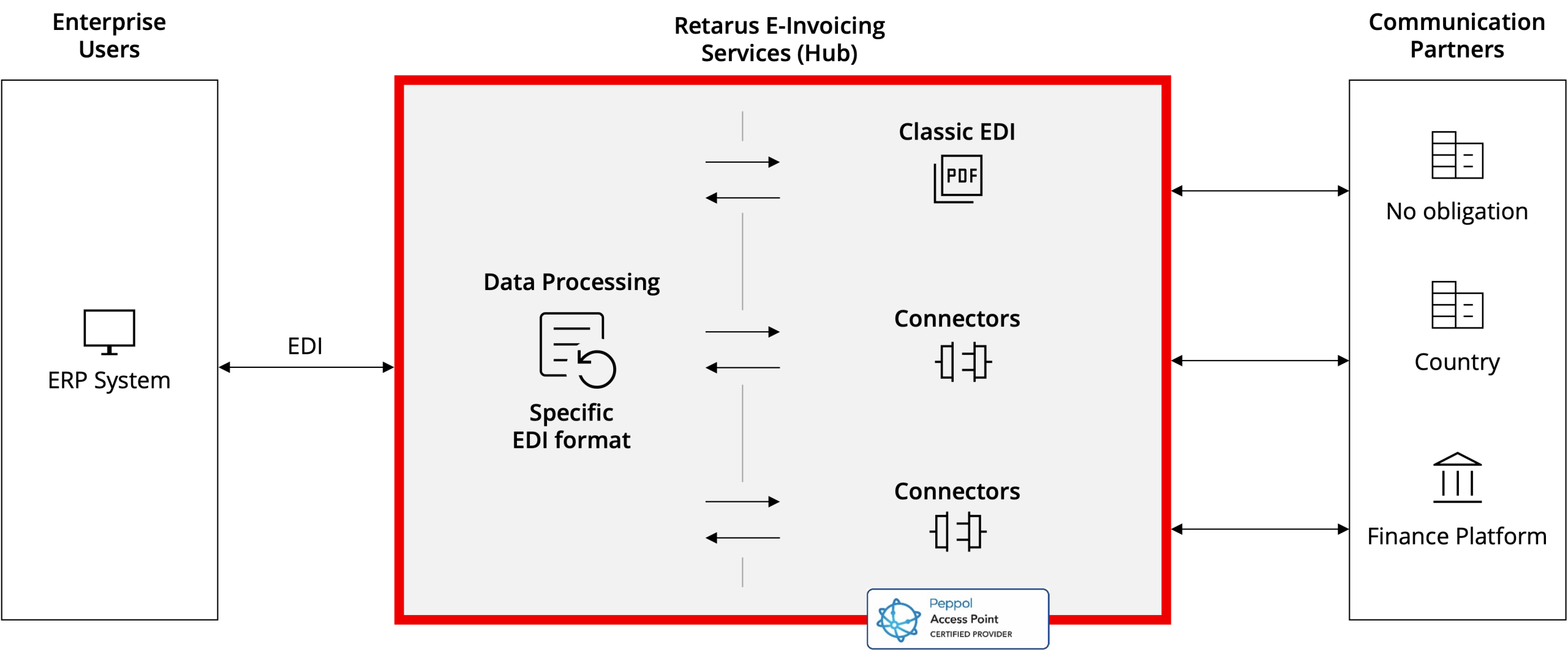

Your hub for digital invoicing

Access global invoicing networks

Streamline your invoice processing

Available all around the globe

The Retarus Advantage

Modular system

Tailored integration

Decades of experience

Customer Ratings and Reviews

Features

Why Choose Retarus E-Invoicing?

Flexible IT integration

30+ years of expertise

Uncompromising data sovereignty

Implementation backed up by SLA – in time and on budget

Even more efficiency and security for your e-invoicing

Automated capturing of PDFs

PDF invoices still require effort? Retarus Intelligent Document Processing captures and validates them automatically – AI-assisted and master-data verified.

Peppol Access Point

Send and receive e-invoices via Peppol – with our certified Access Point replacing EDI channels.

PDF generation

Automatically render digital invoices as PDFs – ideal for archiving and audit readiness.

Long-term archiving (LTA)

Archive documents securely and compliantly – in line with GoBD and global standards.

What's next?

More from Retarus – Knowledge, trends and practice

Experience you can rely on

Discover how companies are digitalizing invoice workflows – and why they choose Retarus.

White papers by Retarus Experts

Insight into the latest industry and technology trends. Download our latest white paper.

News, trends and insights

Stay up to date on important product and sector developments with our corporate blog.

Frequently Asked Questions

How is the solution integrated into existing systems?

Our solution connects via existing ERP interfaces such as SAP or Microsoft Dynamics. No additional software is required. Custom APIs can also be integrated seamlessly.

Who is subject to mandatory e-invoicing requirements?

Regulations vary by country. Generally, all VAT-registered companies in the B2B sector must send e-invoices. Small business or VAT-free transactions are mostly exempt.

Which formats are permissible for e-invoices?

E-invoices must be transmitted in machine-readable formats like XRechnung or ZUGFeRD. These comply with the EU EN16931 standard for automated processing. Other formats may be allowed depending on the country.

Which countries are supported by the solution?

Retarus Global E-Invoicing supports global requirements across Europe, the Americas, and the Asia-Pacific region. We also provide access to Peppol and other CTC networks.

Which international regulations are there for e-invoicing?

Across the globe, a growing number of countries are introducing mandatory e-invoicing, including:

- Malaysia: IRBM (Inland Revenue Board of Malaysia)

- Romania: ANAF (Agenția Națională de Administrare Fiscală)

- Poland: KSeF (Krajowy System e-Faktur)

- Italy: SDI (Sistema di Interscambio) and FatturaPA