2022 was an eventful year for e-invoicing in Germany and its neighboring countries. Germany, Switzerland, Poland, France, and Italy — all have published new requirements and deadlines for B2B and B2G e-invoicing.

That is why our last webinar this year looked at the continuously changing national regulations, technically complex invoicing systems, and firm implementation deadlines for every VAT-registered company in Central Europe. The 30-minute presentation in German, which is now also available on demand (see below), provides an overview of the current developments in XRechnung, Peppol, FatturaPA, Chorus Pro, KSeF, and QR Invoice.

What Are the New E-Invoicing Requirements in Germany?

In line with a number of other European countries, Germany currently still follows what is known as a post-audit model. This means B2B invoices are sent directly to the end recipient, an advance VAT return is due at the end of the month, and individual companies are randomly audited by the government.

For invoices sent to public administration in Germany, XRechnung has been the standard since April 2020. However, the various federal states in Germany are at different stages of implementation. In line with the principle of federalism, the federal and state governments have entrusted different IT providers with implementation. The deadlines and the model landscape of the transmission channels for XRechnung have become just as varied. This ranges from web portals and email to Peppol (Pan-European Public Procurement OnLine) and even De-Mail (negligible). Authorities in the federal government and in Baden-Württemberg no longer accept PDF invoices. The other states are gradually following suit, for example Mecklenburg-Western Pomerania in 2023, as well as Rhineland-Palatinate and Hesse in 2024.

In addition to the heterogeneous landscape, updates to the XRechnung standard are ongoing. The last update to version 2.2.0 took place in August of this year.

In Europe, Peppol is a good alternative for exchanging business data in a structured way. In Northern Europe in particular, it has become the standard for sending electronic invoices to public authorities. The German federal government and eleven of its federal states and their municipalities can already be contacted via Peppol. The next steps for implementation that were decided on by the IT Planning Council have increased pressure on the remaining states to connect all public-sector clients to the Peppol network by October 1, 2023.

How to Prepare for Digital Invoicing in Germany

- Prepare ERP systems for identification codes (Peppol ID, Leitweg ID, email addresses, etc.)

- Define an electronic transmission indicator (recommendation: Peppol, if ID available)

- Register with all available portals; activate channel if necessary

- Proactively identify Leitweg IDs, Peppol IDs, and/or public agency email addresses

- In the ERP system, change to XRechnung for the sending of invoices to federal and state institutions (regardless of amount/exceptions, etc.) across the board

- For implementation and the technical connection, select a service provider that can handle all formats and channels:

- Peppol Access Point

- Managed EDI Services

- Reliable email infrastructure (for recipients without Peppol)

Italy: E-Invoicing Also for Foreign Transactions Since 2022

Italy is the pioneer in e-invoicing in Europe and introduced the clearance model for domestic transactions at a very early stage. Since July 1, 2022, foreign transactions must also be processed and reported via the SDI system. In return, quarterly reporting of foreign transactions has been eliminated. Digital archiving is nevertheless mandatory.

Specifically, Italian companies must report outgoing invoices and, in some circumstances, transmit the data in additional formats. Incoming invoices (e.g., PDFs) must be digitized and also transmitted to the SDI system no later than the 15th of the following month.

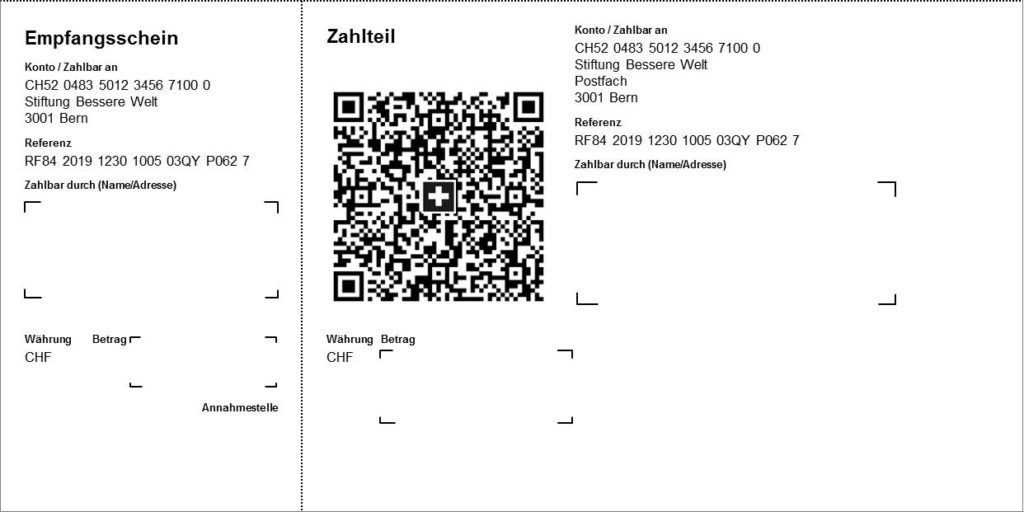

Switzerland: A Different Approach Using QR Codes

Switzerland made the “Swiss QR” invoice mandatory as of October 1, 2022. This special QR code replaces the classic payment slip and applies to both B2B and B2C invoices. By scanning the QR code, recipients are able to make a payment at the touch of a button.

Service providers can help digitize and automate invoicing with EDI data. It is important to note that the layout is highly standardized and the contents are clearly defined. For example, the QR code must be located either at the bottom of the invoice or on an additional final page.

Poland: Mandatory B2B E-Invoicing Postponed Again

Poland originally had planned to introduce a mandatory clearance model for domestic invoices as of January 2023. However, operation of the highly complex system “KSeF” (Krajowy System e-Faktur) has been anything but smooth from a technical point of view and is not expected to be introduced for B2B until a year later (January 1, 2024).

Invoice data in EDI format can either be uploaded via a portal or transferred via APIs. Companies are allowed to outsource and use service providers for the technically complex connection to interfaces and the necessary conversion, as well as for EDI transmission.

The date for KSeF introduction has already been postponed several times. It therefore remains to be seen whether the target date is actually the final date. The current status can be checked at https://www.podatki.gov.pl/ksef/, and the portal is ready for testing.

France: E-Invoicing Mandatory for B2B as of 2024

As previously reported in detail in an earlier article, mandatory regulations in France for B2B e-invoicing and e-reporting will take effect July 1, 2024.

Specifically, companies in France must be able to receive invoices in electronic form as of July 2024 and must issue electronic invoices themselves no later than January 2026. This is also required for foreign companies that are subject to VAT in France. All B2B invoice processing will then be handled by the central “Chorus Pro” system.

A Single Solution for All Requirements and Communication Channels

Retarus E-Invoicing is a cost-efficient cloud solution, developed with EDI DNA and more than 27 years’ experience. It complies with international regulations and meets the highly diverse technical requirements in different countries. As a certified PEPPOL Access Point and member of several local e-invoicing associations, Retarus offers its customers legally compliant e-invoicing for B2G, B2B and B2C in Europe and around the globe, always in compliance with international standards.

Find out more about Retarus E-Invoicing on our website or directly from your local Retarus representative.